Quick estimate tax return

Tax Calculator for 2021 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income Deductions. This calculator will help you work out your tax refund or debt estimate.

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

You pay federal income taxes on a pay-as-you-go basis.

. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax. Use the Quick Estimator to quickly calculate results for an individual 1040 return.

Start the TAXstimator Then select your IRS Tax Return Filing Status. The burden is on you to pay estimated taxes four times a year April 15 June. When figuring your estimated tax for the.

Ability to estimate health insurance penalties separately. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Keystone Tax Solutions Pro contains a module that allows you to quickly input basic information for a client to provide an estimate of the refund or balance due on their tax.

Information about Form 4466 Corporation Application for Quick Refund of Overpayment of Estimated Tax including recent updates related forms and instructions on. You can get a rough estimate by just finding out what tax bracket you fall into. It is mainly intended for residents of the US.

To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. Quick Estimate Quick Calculation Of A Tax Return TaxSlayer Pro contains a module that allows you to quickly input basic information for a client to provide an. Accurately estimate 1040EZ 1040A and limited 1040.

This tells you your take-home. Enter your filing status income deductions and credits and we will estimate your total taxes. You can also create your new 2022 W-4 at the end of the tool on the tax.

It can be used for the 201516 to 202122 income years. How to estimate your quarterly taxes. Quick Tax Estimator which includes.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. We will send you a personalised list of tax deductions to help maximise your refund. Calculates Child Care Credit EIC.

And is based on the tax brackets of 2021. Use our tax refund calculator to get an estimate on your tax refund based on your income. On this page Before you use the calculator Whats new for.

The following information about the Quick Estimator is available at Tools Quick Estimator in the. There are a number of free calculators available online that can give you a quick ballpark figure. Based on your projected tax withholding for the year we can also estimate your tax refund or.

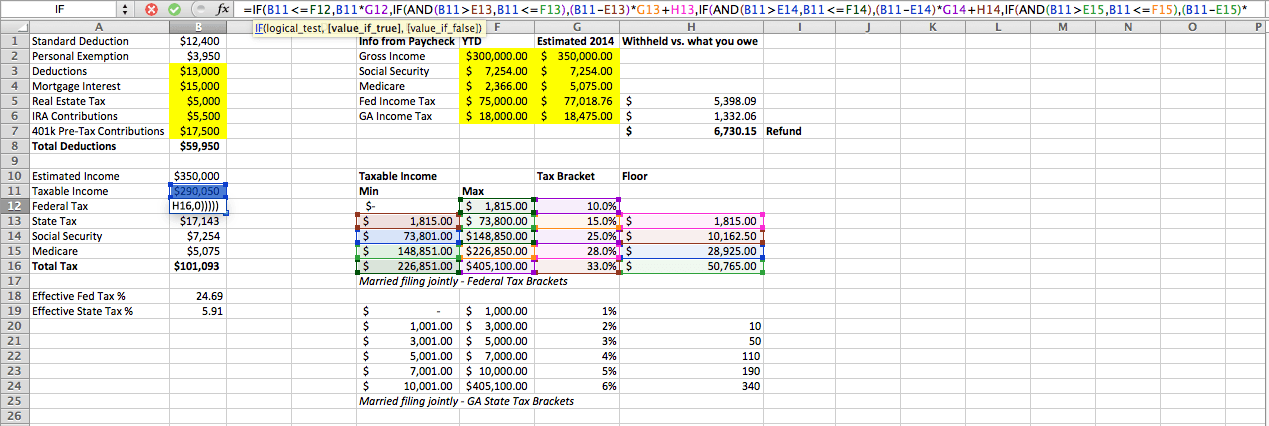

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

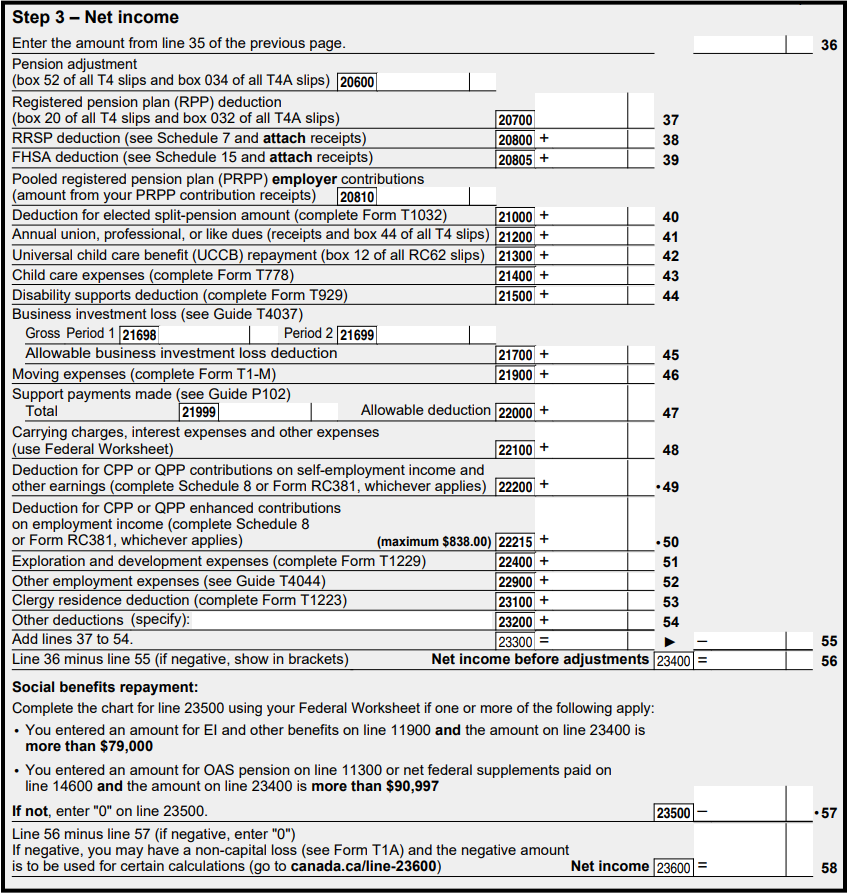

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Do I Need To File A Tax Return Forbes Advisor

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca